As marketers, we work tirelessly to move the needle on what often seems like a laundry list of metrics. We look at website visits, conversion rates, generated leads per channel, engagement on social media platforms, blog post shares, email click-through rates… and the list goes on and on. When the time comes to present the impact of your marketing efforts to your boss, you can’t present him or her with everything you measure. While many bosses theoretically understand that a solid marketing team can directly impact your company’s bottom line, 73% of executives don’t believe that marketers are focused enough on results to truly drive incremental customer demand. If the majority of executives think marketing programs lack credibility, it simply doesn’t make sense to bombard them with metrics that don’t indicate bottom-line impact. When it comes to marketing metrics that matter to your execs, expect to report on data that deals with the total cost of marketing, salaries, overhead, revenue, and customer acquisitions. This guide will walk you through the six critical marketing metrics your boss actually wants to know. Let’s get started.

Customer Acquisition Cost (CAC)

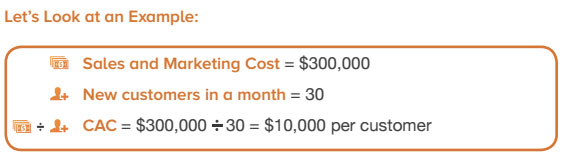

What It Is: The Customer Acquisition Cost (CAC) is a metric used to determine the total average cost your company spends to acquire a new customer.

How to Calculate It: Take your total sales and marketing spend for a specific time period and divide by the number of new customers for that time period.

Marketing Costs = Expenses + salaries + commissions and bonuses + overhead for the marketing department only

Sales and Marketing Cost = Program and advertising spend + salaries + commissoins and bonuses + overhead in a month, quarter or year

Formula: Marketing Cost Sales and Marketing Costs = M%-CAC

What This Means and Why It Matters: CAC illustrates how much your company is spending per new customer acquired. You want a low average CAC. An increase in CAC means that you are spending comparatively more for each new customer, which can imply there’s a problem with your sales or marketing efficiency.

See also: 3 basic strategies in Digital Marketing

Marketing % of Customer Acquisitions Cost

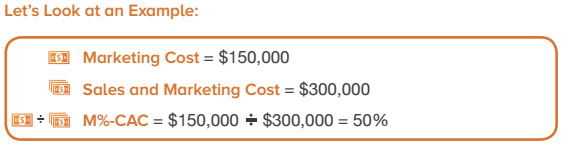

What It Is: The Marketing % of Customer Acquisition Cost is the marketing portion of your total CAC, calculated as a percentage of the overall CAC.

How to Calculate It: Take all of your marketing costs, and divide by the total sales and marketing costs you used to compute CAC.

Marketing Costs = Expenses + salaries + commissions and bonuses + overhead for the marketing department only

Sales and Marketing Cost = Program and advertising spend + salaries + commissoins and bonuses + overhead in a month, quarter or year

Formula: Marketing Cost Sales and Marketing Costs = M%-CAC

Let’s Look at an Example:

Marketing Cost = $150,000

Sales and Marketing Cost = $300,000

M%-CAC = $150,000 $300,000 = 50%

What This Means and Why It Matters: The M%-CAC can show you how your marketing teams performance and spending impact your overall Customer Acquisition cost. An increase in M%-CAC can mean a number of things:

- Your sales team could have underperformed (and consequently received) lower commissions and/or bonuses.

- Your marketing team is spending too much or has too much overhead

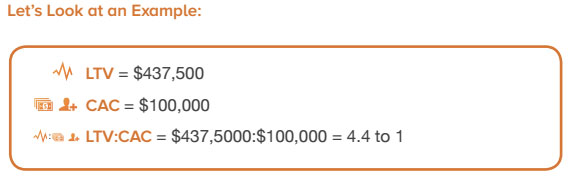

Ratio of Customer Lifetime Value to CAC (LTV:CAC)

What It Is: The Ratio of Customer Lifetime Value to CAC is a way for companies to estimate the total value that your company derives from each customer compared with what you spend to acquire that new customer.

How to Calculate It: To calculate the LTV:CAC you’ll need to compute the Lifetime Value, the CAC and find the ratio of the two.

Lifetime Value (LTV) = (Revenue the customer pays in a period – gross margin) Estimated churn percentage for that customer

Formula: LTV:CAC

What This Means and Why It Matters: The higher the LTV:CAC, the more ROI your sales and marketing team is delivering to your bottom line. However, you don’t want this ratio to be too high, as you should always be investing in reaching new customers. Spending more on sales and marketing will reduce your LTV:CAC ratio, but could help speed up your total company growth.