Last year, The Philippine Roadmap for Digital Startups (a government initiative to spur innovative startups) supported and helped launch a number of incubators and accelerator programs. Some of these include the AIM-Dado Banatao incubator, Startup Village, Voyager Innovations, and the Google Launchpad accelerator. The senate also passed two bills related to startups: the Innovative Startup Act and the Philippine Innovation Act.

It was also last year that the Philippines had its first unicorn, Revolution Precrafted.

At large, Southeast Asia’s internet economy has grown exponentially. Recent findings from Google and Temasek indicate that the SEA internet economy is growing faster than expected, surpassing its US$200 billion estimate. And while online travel is still the biggest segment in terms of internet-based spending, ecommerce has leapt from 5.5 billion in 2015 to 7.9 billion in 2017. By 2025, the industry is projected to hit US$88.1 billion to become the most valuable segment in the SEA internet economy.

With the growing startup scene in the Philippines and the exciting ecommerce growth in SEA, iPrice Group analyzed the online performance of the top ecommerce players in the Philippines over the past year. We used the following metrics for this analysis: Google search interest, iOS and Google Play mobile shopping application rankings, and Facebook popularity.

Here’s the summary based on our findings:

- Lazada dominates in all verticals while Shopee emerged as the fastest growing ecommerce platform.

- Despite the lead of international players, Beauty MNL was among the top five iOS and Google Play mobile shopping ecommerce apps.

- Kimstore was the second most popular Facebook ecommerce page and the most searched local player.

The most searched ecommerce platform

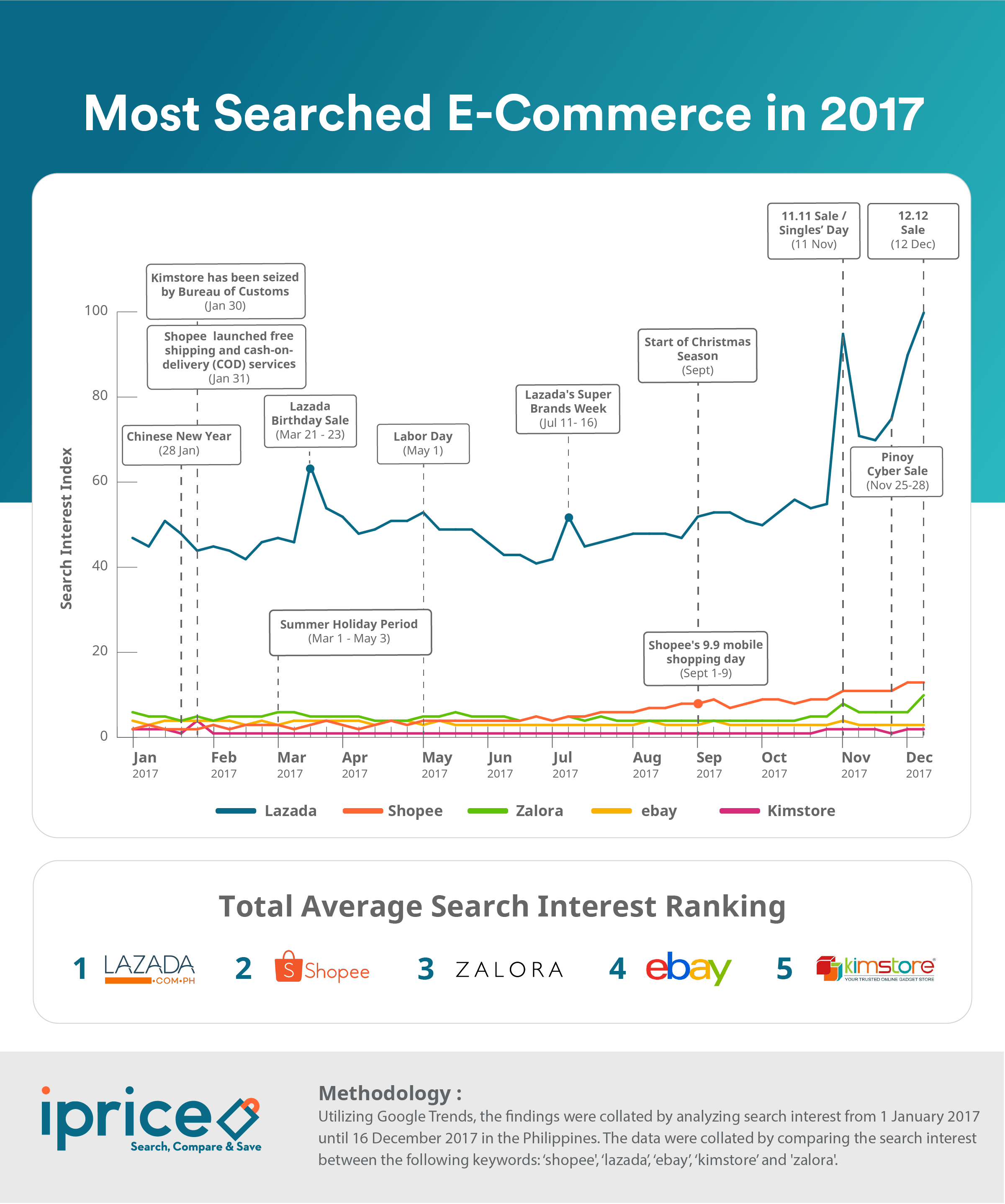

In Q1 2017, the Alibaba-backed Lazada hit a record high 91 percent market share in the Philippines. To date, Lazada has the highest ecommerce search interest penetration, with a maximum 42 percent search interest lead over Shopee, Zalora, eBay, and Kimstore, respectively.

Lazada shows no signs of slowing down with its logistics infrastructure expansion. Alibaba subsidiary Ant Financial also invested in Globe Telecom’s fintech arm Mynt to develop a mobile payment system.

Despite Lazada’s lead in the country, Sea’s Shopee quickly grew to overtake Zalora for second place at the end of July, the same month it celebrated its founding anniversary. One of Shopee’s all-time highs was during the launch of its first mega sale “9.9” campaign last September, which coincided with Sea’s US$1 billion IPO. JG Summit (a Gokongwei-led Philippine retail conglomerate) placed a US$550 million stake in Sea, which will be leveraged for the growth of Shopee’s platform.

The most popular online sale periods

With the success of Alibaba’s Singles Day sale, which has surpassed Black Friday and Cyber Monday since 2012, more ecommerce players in SEA have jumped on the bandwagon. While Lazada’s lead in Google search interest has been consistent throughout all quarters, its biggest leads came during its “Online Revolution” campaign. The campaign was adapted from Singles Day but extending with the platform’s own “12.12” sale. Surprisingly, 12.12 has proven to be the most popular online sale for Lazada, even for its competitors Shopee and Zalora.

The biggest online sale period happened during the “sale season” or the holiday season which starts as early as September in the Philippines. This can be attributed to the traffic congestion during this time. Aside from Christmas events, one of the biggest online sale periods happened during the end of Q1 and at the beginning of Q2. This can be attributed to the summer holidays and Labor Day in the country. Products people are most interested in during these months (March, April, and May) are apparel and home appliances.

Top mobile shopping apps

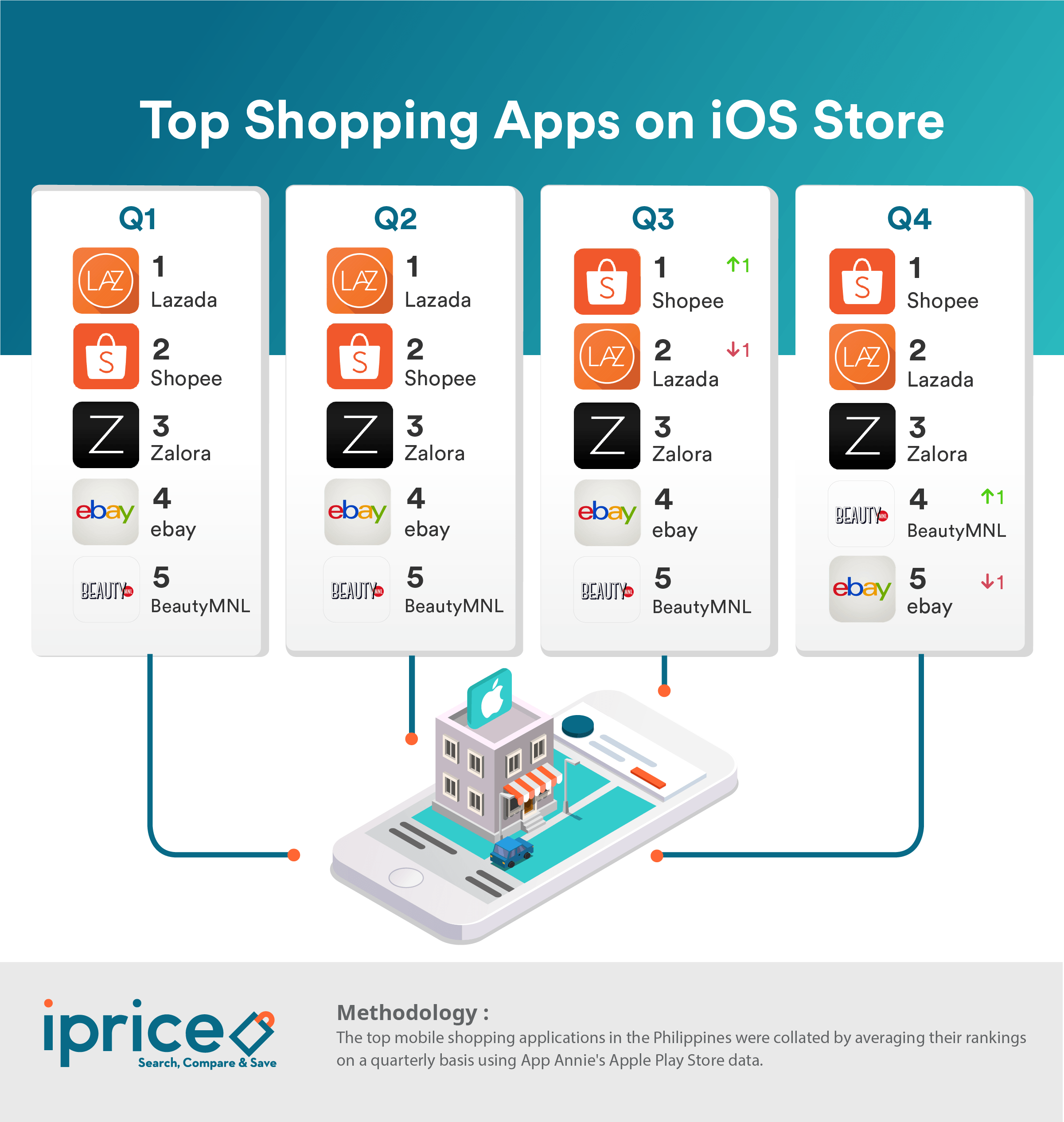

Lazada leads in Google Play mobile shopping apps for 2017 in all quarters, followed by Shopee. Meanwhile, Shopee leads in iOS mobile shopping apps for Q3 and Q4, ending Lazada’s lead in the first two quarters. The Lazada-Voyager Solutions partnership enables consumers using Lazada’s mobile app to browse the platform without being charged for data consumption. The platform has been actively pushing their mobile application since more than 60 percent of their sales come from mobile devices.

In Q2, Goods (a local m-commerce platform) jumped to fifth place, replacing Sephora. By Q4, Beauty MNL (another local m-commerce platform) overtook eBay for the fourth spot, dethroning Goods in the top five list. Last December 2017, Robinsons Retail Holdings (the retail arm of JG Summit Holdings) acquired 20 percent of Taste Central (the company operating Beauty MNL).

Most popular ecommerce platforms on Facebook

According to Google and Temasek’s 2017 forecast, SEA is expected to have a significant increase in its mobile internet usage (up to 3.6 hours per day) by this year. Hence, social commerce or sales driven by social media is expected to also increase in SEA over the coming years, despite it adding up to only 30 percent of total online sales in 2016.

In the Philippines, the most followed ecommerce platform is Lazada with more than 6.6 million likes. The local ecommerce platforms that dominated the list were Kimstore, Goods, and Eazy Fashion with 2.4 million, 1.3 million, and 1.1 million likes, respectively.

Methodology

Most searched ecommerce platforms: Using Google Trends, the findings were collated by analyzing search interest from January 1, 2017 until December 16, 2017 in the Philippines. The data was collated by comparing the search interest between the following keywords: Shopee, Lazada, eBay, Kimstore, and Zalora.

Most popular mobile shopping app: The top mobile shopping applications in the Philippines were collated by averaging their rankings on a quarterly basis using App Annie’s Google Play data and Apple Store data.

Most popular ecommerce platofmr on Facebook: The data set was provided by Socialbakers.